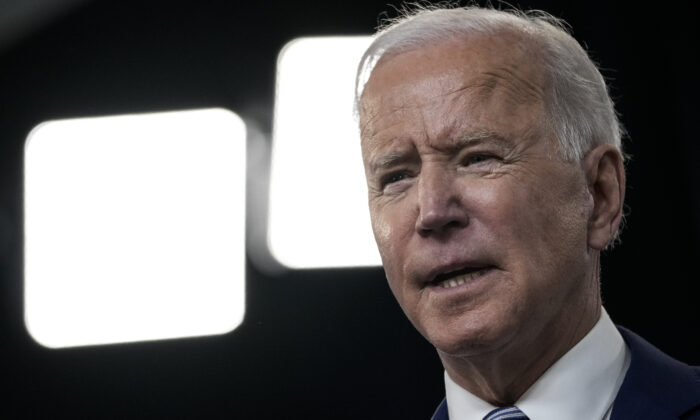

President Joe Biden delivers remarks on the COVID-19 response and the state of vaccinations in the South Court Auditorium at the White House complex in Washington, on March 29, 2021. (Drew Angerer/Getty Images) Executive Branch

By Jack Phillips March 31, 2021 Updated: March 31, 2021 biggersmallerPrint

As President Joe Biden is slated to unveil a sweeping infrastructure bill Wednesday, the U.S. Chamber of Commerce said that the way it would be funded—via an increase in taxes—is “dangerously misguided.”

“Properly done, a major investment in infrastructure today is an investment in the future, and like a new home, should be paid for over time—say 30 years—by the users who benefit from the investment,” the lobbying group said. “We strongly oppose the general tax increases proposed by the administration which will slow the economic recovery and make the U.S. less competitive globally—the exact opposite of the goals of the infrastructure plan.”

Biden’s proposal, which is known as the American Jobs Plan, will be revealed Wednesday in Pittsburgh. Details of the plan have been leaked to the press in recent days, including investments in “green” energy sources, more Internet access, more highways, and housing. A tax increase would target corporations.

“The hard work of achieving bipartisan consensus is the best and only realistic path to enactment of historic infrastructure legislation,” the Chamber of Commerce said. “While today’s action, coupled with continued efforts to find consensus from bipartisan groups in both the House and Senate is encouraging and a start in a long process, we urge both Democrats and Republicans to avoid further partisan gridlock and provide productive solutions to get an infrastructure bill passed this year.”

The White House released a fact sheet on the plan Wednesday morning.

“Alongside his American Jobs Plan, President Biden is releasing a Made in America Tax Plan to make sure corporations pay their fair share in taxes and encourage job creation at home,” the White House said. It added: “Another study found that the average corporation paid just 8 percent in taxes. President Biden believes that profitable corporations should not be able to get away with paying little or no tax by shifting jobs and profits overseas. President Biden’s plan will reward investment at home, stop profit shifting, and ensure other nations won’t gain a competitive edge by becoming tax havens.”

The corporate tax rate lowered from 35 percent to 21 percent under former President Donald Trump by Republicans who said it would help businesses grow and spur job creation efforts.

Another change would apply a new tax on foreign subsidiaries of American companies.

“Right now, the tax code rewards U.S. multinational corporations that shift profits and jobs overseas with a tax exemption for the first ten percent return on foreign assets, and the rest is taxed at half the domestic tax rate,” the White House fact sheet stated.

The Epoch Times has contacted the White House for comment.