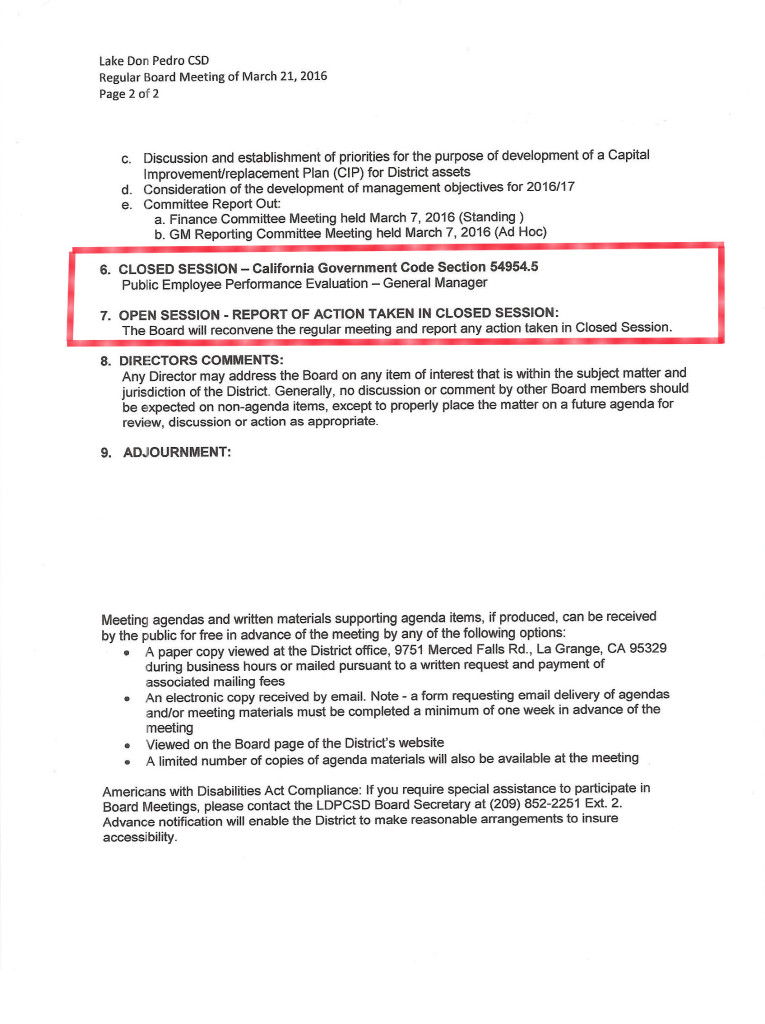

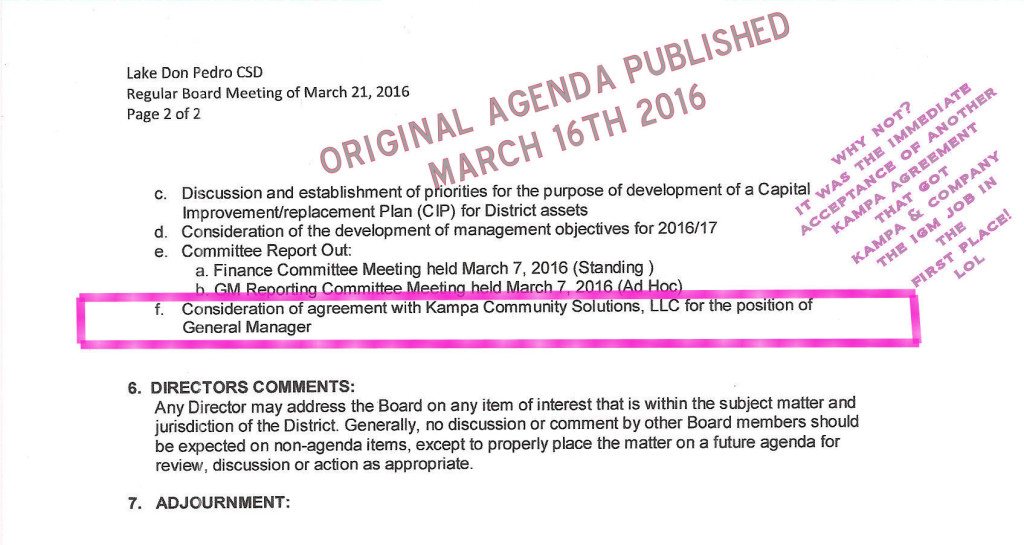

Apparently someone caught a procedural error in the first agenda (#5 DISCUSSION AND ACTION ITEM f: Consideration of agreement with Kampa Community Solutions, LLC for the position of General Manager) issued March 16th for the LDPCSD Meeting on Monday, March 21st, 2016.

The new “revised agenda published on March 18th” corrected the previous agenda plan of immediately promoting PETE KAMPA’s “KAMPA COMMUNITY SOLUTIONS, LLC for “the position of General Manager” without the district Board of Directors having first performed a “public Employee Performance Evaluation – General Manager”.

I believe it a pretty well established process that an organization is supposed to complete a performance evaluation prior to promoting an interim GM to full General Manager status.

(Technically PETE KAMPA and the Board of Directors have OBVIOUSLY been using the unqualified General Manager title for quite some time in press releases and District correspondence anyway.)

PLEASE REFER TO HOW PETE KAMPA REFERS TO HIS POSITION WHEN INTRODUCING HIMSELF TO THE MERCED IRRIGATION DISTRICT IMMEDIATELY AFTER APPOINTMENT AS THE INTERIM GM:

(Naturally there was MUTUAL AWARENESS from the first KAMPA LDPCSD employment tour)

You would think such a professional special district management company as KAMPA COMMUNITY SOLUTIONS LLC would know these general manager promotion procedures. Of course they do! But such procedural details only impede progress on the real reasons PETE KAMPA/KAMPA COMMUNITY SOLUTIONS LLC was hired (and retained) by the Board of Directors:

- to begin providing water service to properties previously prohibited due to being outside the legal Place of Use under the water license under which the LDPCSD operates.

- new ground wells had to be constructed with public funds and grant money.

- the new wells would be advertised as being necessary for existing water consuming customers during emergency drought conditions.

- in actuality the wells were always planned and intended to be used as the “alternate source of water” required to provide many outside legal area properties with water.

- the plan would require continued public funding of this special benefit of ground water substitution program by the 99% of legally entitled Merced River water users.

Such activity by our Board of Directors and their chosen GM is even more outrageous when you consider there was no legitimate legal duty or obligation to provide this special benefit to outside POU properties. Look at the DISTRICT FORMATION DOCUMENTS.

HASTE MISTAKES?

Does PETE KAMPA, his KAMPA COMMUNITY SOLUTIONS LLC management company, and his “Board majority” of appointed Directors appear to be in too much of a hurry when considering such mistakes, revisions, corrections, sudden “course changes”, retroactive approval of past activities, and the limiting of district information previously furnished to the public?

(Can you imagine the directors on the current board discussing this likely KAMPA prepared promotion in Closed Session? “Oh golly gee – KAMPA COMMUNITY SOLUTIONS has done such a fantastic job FOR US in setting up even further DISTRICT WATER SERVICE EXPANSION UTILIZING GROUND WATER SUBSTITUTION TO CIRCUMVENT THE PLACE OF USE RESTRICTIONS IN WATER LICENSE 11395 TO BE PAID FOR BY ALL CUSTOMERS – this COMPANY has certainly earned the position as general manager” or, “We’re in for a dime, so we’re in for a dollar” (More accurately “In for a dollar – in for millions of dollars so we had better stick with our original plan –why change horses in the middle of a stream?”) lol Whatever. They do as they please.

WHY A COMPANY AND NOT A TRADITIONAL “REAL PERSON” AS GM?

Corporations and limited liability companies under the law are treated as individuals – actually having legal rights that recognize them as such. Someone might then reasonably inquire,

“Why would the LDPCSD BOARD OF DIRECTORS hire a company as the General Manager rather than the president of that company, in this case the corporation’s namesake, PETE KAMPA?”

This is a very good question which addresses the primary motive for PETE KAMPA’S creating a “Limited Liability Company” in the first place. The business name designation is the actual answer:

“REDUCED LIABILITY EXPOSURE for actions that could result in law suits for causing harm to the district and/or its customers.

(CORRECTION: Actually anyone harmed.)

[Directors on a board also traditionally have a similar “cloak of protection” from lawsuits unless evidence exists of intentional wrongful behavior beyond the simple “error and omissions” insurance coverage like when individual members conspire to commit theft, fraud, etc. …]Information on LLCs from Wikipedia: https://en.wikipedia.org/wiki/Limited_liability

_________________________

“A Limited Liability Company (LLC) is a hybrid business entity having certain characteristics of both a corporation and a partnership or sole proprietorship (depending on how many owners there are). An LLC, although a business entity, is a type of unincorporated association and is not a corporation. The primary characteristic an LLC shares with a corporation is limited liability, and the primary characteristic it shares with a partnership is the availability of pass-through income taxation. It is often more flexible than a corporation, and it is well-suited for companies with a single owner.”

“In the absence of express statutory guidance, most American courts have held that LLC members are subject to the same common law alter ego piercing theories as corporate shareholders. However, it is more difficult to pierce the LLC veil because LLCs do not have many formalities to maintain. So long as the LLC and the members do not commingle funds, it would be difficult to pierce this veil.[citation needed] Membership interests in LLCs and partnership interests are also afforded a significant level of protection through the charging order mechanism. The charging order limits the creditor of a debtor-partner or a debtor-member to the debtor’s share of distributions, without conferring on the creditor any voting or management rights.[citation needed] Limited liability company members may, in certain circumstances, also incur a personal liability in cases where distributions to members render the LLC insolvent.[4]”

“Limited liability is where a person’s financial liability is limited to a fixed sum, most commonly the value of a person’s investment in a company or partnership. If a company with limited liability is sued, then the [claimant]]s are suing the company, not its owners or investors. A shareholder in a limited company is not personally liable for any of the debts of the company, other than for the value of their investment in that company. This usually takes the form of that person’s dividends in the company being zero, since the company has no profits to allocate. The same is true for the members of a limited liability partnership and the limited partners in a limited partnership.[1] By contrast, sole proprietors and partners in general partnerships are each liable for all the debts of the business (unlimited liability).”

“Piercing the corporate veil or lifting the corporate veil is a legal decision to treat the rights or duties of a corporation as the rights or liabilities of its shareholders. Usually a corporation is treated as a separate legal person, which is solely responsible for the debts it incurs and the sole beneficiary of the credit it is owed. Common law countries usually uphold this principle of separate personhood, but in exceptional situations may “pierce” or “lift” the corporate veil.

A simple example would be where a businessman has left his job as a director and has signed a contract to not compete with the company he has just left for a period of time. If he sets up a company which competed with his former company, technically it would be the company and not the person competing. But it is likely a court would say that the new company was just a “sham”, a “cover” or some other phrase,[1] and would still allow the old company to sue the man for breach of contract. A court would look beyond the legal fiction to the reality of the situation.

Despite the terminology used which makes it appear as though a shareholder’s limited liability emanates from the view that a corporation is a separate legal entity, the reality is that the entity status of corporations has almost nothing to do with shareholder limited liability.[2] For example, English law conferred entity status on corporations long before shareholders were afforded limited liability. Similarly, the Revised Uniform Partnership Act confers entity status on partnerships, but also provides that partners are individually liable for all partnership obligations. Therefore, this shareholder limited liability emanates mainly from statute.[2]”

_________________________

WOW!

There is so much legal information to absorb and understand concerning this LIMITED LIABILITY COMPANY stuff, how can a regular customer possibly comprehend what is actually happening?

Wouldn’t it be nice if there was a short descriptive sentence or something explaining this complex situation?

Here is something that might help –

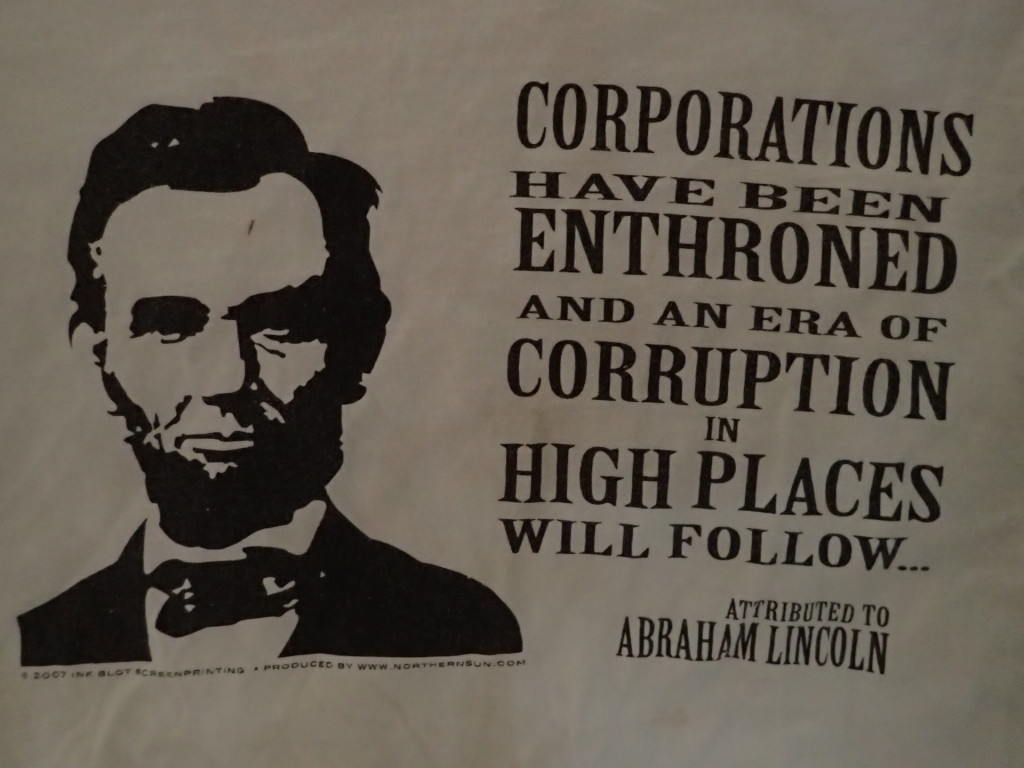

A quote attributed to Abraham Lincoln which in my mind sums up the above information as well as the current “behind the scene activities” taking place within our LAKE DON PEDRO COMMUNITY SERVICES DISTRICT management:

“Corporations have been enthroned and an era of corruption in high places will follow”.

http://www.ratical.org/corporations/Lincoln.html

Basically, a lack of individual accountability for wrongful actions. This was a lesson most of us were taught as children.

Isn’t this “Public Service” stuff interesting?

My best to you and yours, Lew